SAP TRM Course in Mumbai

Practical Oriented Training

Learn about SAP TRM with our practical instruction! Develop your career in this profitable sector by becoming proficient in advanced skills. Register now in our SAP TRM Course in Mumbai!

Our Services

Course Information

Comprehensive details about course content, structure & objectives.

1-on-1

Training

Training that is specifically customized to meet each student's needs.

Classroom Training

Live interactive sessions on the course with experienced instructors.

Online

Guidance

Flexible virtual support for effective remote and distant learning.

Key Notes

Key Features

Key Features

Key Features

Key Features

Key Features

Key Features

Expert Faculties: Learn from seasoned professionals with extensive industry experience and knowledge.

Placement Support: Comprehensive career guidance and job placement assistance to ensure students secure their desired job roles.

Resume Building: Craft impressive resumes to highlight your skills and achievements effectively.

Real-Time Project: Engage in practical projects to apply data science concepts in real-world.

Guaranteed Certification: Earn a recognised certification upon successful course completion.

Experience Alteration System: Experience real-world projects and hands-on training, ensuring you are job-ready.

What is SAP TRM?

SAP TRM (Treasury and Risk Management) is a comprehensive module tailored for managing financial risks and optimizing cash flow and liquidity. It plays a crucial role in overseeing financial transactions, market risks, and financial instruments, thus ensuring streamlined treasury operations. SAP TRM seamlessly integrates with other SAP modules such as Financial Accounting (FI), Controlling (CO), and Cash Management to create a unified financial management system. By leveraging real-time data processing, SAP TRM facilitates timely reflection of financial activities, which enhances decision-making and ensures regulatory compliance. For those seeking to implement or advance their knowledge of SAP TRM Course in Mumbai, this module offers a robust solution for managing complex financial scenarios.

Who Can Apply For SAP TRM Course in Mumbai

- Finance professionals looking to specialize in treasury and risk management.

- Graduates and postgraduates in finance, economics, or business administration.

- IT professionals and consultants aiming to expand their expertise in financial technology.

- Data analysts, statisticians, and AI/ML experts interested in financial risk analysis and management.

SAP TRM Syllabus

The SAP TRM Course in Mumbai (Treasury and Risk Management) module focuses on the management of financial transactions and risks, including cash management, liquidity forecasting, and financial risk analysis. It enhances the management of financial assets and liabilities, minimizes risks associated with financial operations, and ensures optimal liquidity. Ideal for organizations aiming to streamline their treasury operations and improve financial stability.

Interview Q&A

SAP TRM (Treasury and Risk Management) is a module in SAP designed to manage financial risks, optimize cash flow, and ensure effective treasury operations. It helps manage financial transactions, market risks, and financial instruments and integrates with other SAP modules such as FI, CO, and Cash Management.

The key components of SAP TRM include Transaction Manager, Market Risk Analyzer, Credit Risk Analyzer, and Portfolio Analyzer. These components help manage different aspects of treasury operations and financial risk.

SAP TRM integrates with Financial Accounting (FI) for general ledger postings, Controlling (CO) for internal cost management, and Cash Management for liquidity planning. This integration ensures a cohesive financial management system.

The Transaction Manager in SAP TRM is used to manage and process financial transactions, including securities, loans, foreign exchange, and derivatives. It supports the entire lifecycle of financial transactions from deal capture to settlement.

The Credit Risk Analyzer in SAP TRM helps manage counterparty credit risks. It monitors credit exposure, evaluates creditworthiness, and manages credit limits to minimize the risk of financial loss due to counterparty default.

6. How does SAP TRM support regulatory compliance?

A: SAP TRM supports regulatory compliance by providing real-time data processing, comprehensive reporting, and audit trails. It helps organizations meet financial regulations and standards such as IFRS, Basel III, and Dodd-Frank.

7. What is Hedge Management in SAP TRM?

A: Hedge Management in SAP TRM involves using financial instruments to mitigate the risk of adverse price movements in an asset. It includes identifying exposures, designating hedges, and assessing hedge effectiveness to ensure proper risk management.

8. How do you handle liquidity management in SAP TRM?

A: Liquidity management in SAP TRM involves planning, monitoring, and managing cash flow to ensure that the organization has sufficient liquidity to meet its financial obligations. This includes cash position management, liquidity forecasting, and funding strategies.

9. What are the main types of financial instruments managed by SAP TRM?

A: SAP TRM manages various financial instruments, including securities, loans, foreign exchange, derivatives, and money market instruments.

10. How does SAP TRM handle foreign exchange transactions?

A: SAP TRM handles foreign exchange transactions through the Transaction Manager, which allows for the recording, processing, and settlement of FX deals, along with managing related risks and hedging strategies.

11. What is the difference between Transaction Manager and Risk Analyzer in SAP TRM?

A: The Transaction Manager focuses on managing financial transactions, while the Risk Analyzer (Market Risk Analyzer and Credit Risk Analyzer) focuses on assessing and managing market and credit risks associated with those transactions.

12. How does SAP TRM help in cash flow optimization?

A: The Accounts Payable (FI-AP) sub-module in SAP FICO manages the organization’s accounts payable transactions, including invoice verification, payment processing, and vendor master data maintenance.

13. How do you perform mark-to-market valuation in SAP TRM?

A: Mark-to-market valuation in SAP TRM is performed by revaluing financial instruments based on current market prices. This involves updating the fair value of assets and liabilities to reflect their current market value.

14. What is a financial instrument in the context of SAP TRM?

A: A financial instrument in SAP TRM refers to any contract that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity. Examples include bonds, stocks, derivatives, and loans.

15. What is the significance of hedge effectiveness testing in SAP TRM?

A: Hedge effectiveness testing in SAP TRM ensures that the hedging strategy is effectively mitigating the identified risks. It involves measuring how well the hedge performs in offsetting changes in the value of the hedged item.

16. What training or certification is available for SAP TRM?

A: Training and certification for SAP TRM are available through SAP Education and authorized training providers, covering core functionalities and advanced features of the module.

A: SAP TRM supports efficiency by automating routine tasks, integrating with other financial systems, and providing tools for real-time monitoring and analysis.

18. Can SAP TRM be used for cash concentration?

A: Yes, SAP TRM supports cash concentration by consolidating cash from multiple accounts into a central account, optimizing liquidity, and reducing banking fees.

19. Can SAP TRM be customized for specific business needs?

A: Yes, SAP TRM can be customized to fit specific business requirements by configuring settings, reports, and processes to align with organizational goals.

20. Can SAP TRM help with global treasury operations?

A: Yes, SAP TRM supports global treasury operations by providing tools for managing multiple currencies, international cash flows, and cross-border transactions.

Why Should You Learn SAP TRM Course in Mumbai?

Learning SAP TRM Course in Mumbai equips you with specialized skills to manage financial transactions, risks, and liquidity effectively. It enhances your ability to make informed financial decisions, ensuring better management of company resources. This course opens up career opportunities in financial management, risk assessment, and treasury operations, making you a valuable asset to organizations aiming to optimize their financial strategies and mitigate risks.

How can we help you in Learning SAP TRM Course in Mumbai?

Connecting Dots ERP is a premier institute that provides the SAP TRM Course in Mumbai. Based on the current industry standards, our program equips students with comprehensive knowledge and skills, enabling them to secure jobs in reputed MNCs. Our course is designed to be pocket-friendly, ensuring that students from all walks of life can join and achieve their career goals.

Our team of trainers at the SAP TRM Course in Mumbai consists of seasoned professionals with a decade of experience in the field. They are experts in their subjects, staying updated with the latest industry trends and applications. Our trainers, who are currently working professionals in top MNCs, provide practical knowledge covering both basic and advanced levels of SAP TRM. They employ a “learning by doing” strategy, offering valuable hands-on exercises and real-world simulations.

The SAP TRM Course in Mumbai syllabus includes Introduction to ERP, Treasury Management, Risk Management, Financial Transactions, Cash Management, Liquidity Management, Market Risk Analysis, Credit Risk Management, Reports, Integration with Other SAP Modules, and more. At the SAP TRM Course in Mumbai, we provide a variety of study materials, including books, video lectures, PDFs, sample questions, interview questions (both HR and technical), and projects. Our skilled trainers, recognized with many prestigious awards for their SAP TRM Course in Mumbai expertise, assist students with major project training, minor project training, live project preparation, interview preparation, and job support. They are adept at teaching technical concepts efficiently and effectively.

Connecting Dots ERP provides state-of-the-art lab facilities and high-tech infrastructure. SAP TRM Course in Mumbai feature efficient lab facilities available 24/7, ensuring that students have ample resources and support to excel in their learning journey.

Our Top Recruiters

Placement Lifecycle

Eligibility Criterion

Interview Question & Answer

Resume and LinkedIn Formation

Mock Interviews

Scheduling Interviews

Job Placement

SAP TRM Training Certificate in Mumbai

Your degree and abilities are pivotal in launching your career, equipping you with the skills to compete on a global scale. These qualifications open doors to opportunities and ensure you stay competitive in the international job market.

FAQs

The SAP TRM course provides critical treasury and risk management skills, hands-on training, and job placement support, boosting your career prospects and professional reputation.

A fundamental grasp of finance and risk management, computer proficiency, and a readiness to learn new technologies are essential.

Yes, free demo sessions are available, giving you a preview of theSAP TRM Course in Mumbai content and teaching style before enrolling.

The SAP TRM course offers personalized mentoring, interactive sessions, and collaborative projects, along with continuous assistance and resources for student success.

The SAP TRM Certification Course spans 4 months, offering a thorough learning journey encompassing theory, practical training, and a live project.

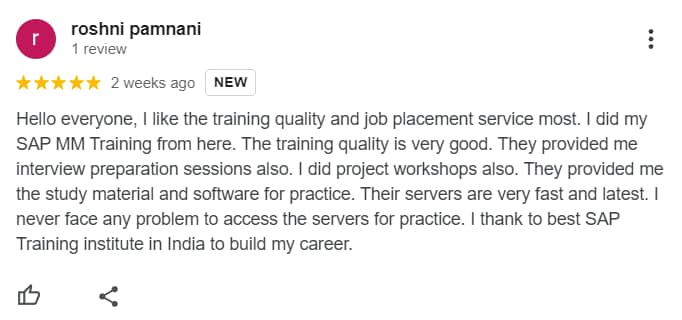

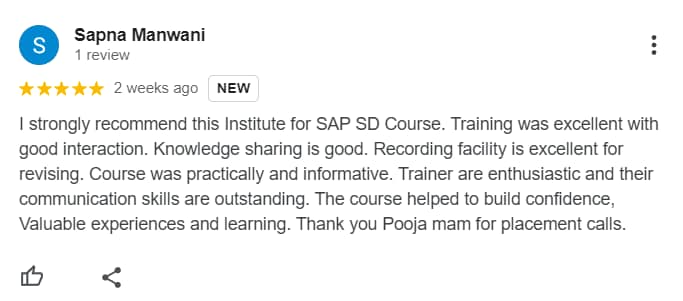

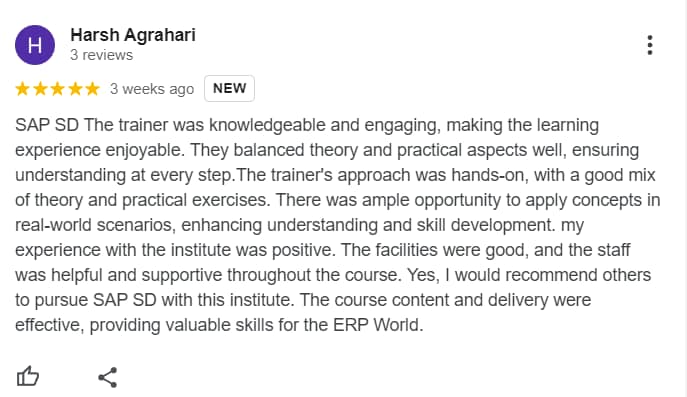

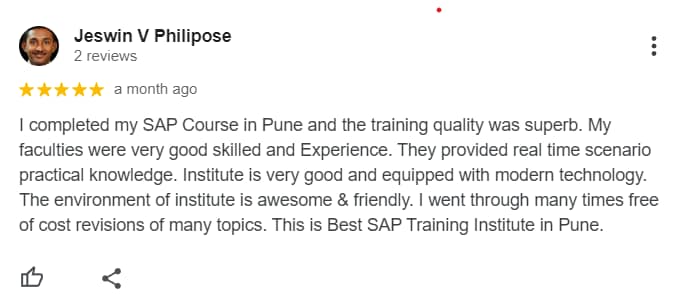

Student Reviews

SAP TRM Course in Mumbai With 100% Placement

The SAP TRM course in Mumbai with 100% placement assistance stands out as an exceptional opportunity for aspiring financial and controlling professionals. This program is meticulously designed to equip students with in-demand skills and practical experience, ensuring they are industry-ready.

Get Industry-Ready with Dedicated Career Support:

- Industry-Ready Advanced Curriculum: Covering essential topics such as machine learning, big data analytics, data visualization, and more.

- Certificate from Connecting Dots ERP: Gain a recognized certification that enhances your professional credibility.

- Expert Faculty: Learn from industry professionals with extensive experience and knowledge.

- Interview Opportunities with Leading Companies: Access exclusive job interview opportunities with top companies.

- Dedicated Placement Assistance: Benefit from personalized support to help secure your ideal job.

- Real-World Case Studies: Engage in hands-on projects and case studies that provide practical exposure.

Connecting Dots ERP provides training for sap courses like SAP FICO, SAP S/4HANA, SAP MM, SAP SD, SAP HCM, SAP PP, SAP QM, SAP PM, and SAP Ariba.

SAP TRM Training in Mumbai

SAP TRM Course in Mumbai Locations: SAP TRM Course fees in Mumbai, SAP TRM Course in Thane, SAP TRM Course in Kalyan, SAP TRM Course in Bhandup, SAP TRM Course in Khopoli, SAP TRM Course in Titwala, SAP TRM Course in Ulhasnagar, SAP TRM Course in Vashi, SAP TRM Course in Badlapur, SAP TRM Course in Ghatkopar, SAP TRM Course in Aroli, SAP TRM Course in virar, SAP TRM Course in ambarnath, SAP TRM Course in Kurla, SAP TRM Course in Diva, SAP TRM Course in Mulund, SAP TRM Course in Matunga, SAP TRM Course in nerul, SAP TRM Course in dadar, SAP TRM Course in andheri, SAP TRM Course in navi mumbai, SAP TRM Course in powai, SAP TRM Course in ghansoli, SAP TRM Course in dombivali, SAP TRM Course in bhiwandi, SAP TRM Course in mulund, SAP TRM Course in bandra, SAP TRM Course in Borivali.

Still have queries? Let’s Connect

Contact US

Pune:

Call us at: 9004002958, 9004002941, 9004008313

Call us at: 9004005382, 7517542233, 9004001938, 8805563870

Pune:

Call us at: 9004002958, 9004002941, 9004008313

Mumbai:

Call us at: 9004005382, 7517542233, 9004001938, 8805563870