SAP FICO Course in Mumbai

Job Oriented Training

An SAP FICO course is crucial as it equips professionals with essential skills in financial management and controlling, vital for effective business operations. It also enhances career prospects by meeting the high demand for SAP FICO experts in various industries.

Our Services

Course Information

Comprehensive details about course content, structure & objectives.

1-on-1

Training

Training that is specifically customized to meet each student's needs.

Classroom Training

Live interactive sessions on the course with experienced instructors.

Online

Guidance

Flexible virtual support for effective remote and distant learning.

Key Notes

Key Features

Key Features

Key Features

Key Features

Key Features

Key Features

Expert Faculties: Learn from seasoned professionals with extensive industry experience and knowledge.

Placement Support: Comprehensive career guidance and job placement assistance to ensure students secure their desired job roles.

Resume Building: Craft impressive resumes to highlight your skills and achievements effectively.

Real-Time Project: Engage in practical projects to apply data science concepts in real-world.

Guaranteed Certification: Earn a recognized certification upon successful course completion.

Experience Alteration System: Experience real-world projects and hands-on training, ensuring you are job-ready.

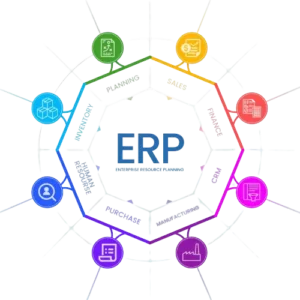

What is SAP FICO?

The SAP FICO includes detailed training on the Financial Accounting (FI) and Controlling (CO) modules, essential for managing financial transactions and internal cost monitoring. The FI module focuses on recording accurate financial data for external reporting, ensuring compliance with regulations. Meanwhile, the CO module aids in budgeting and internal cost control, enabling efficient expense management and profitability tracking. This course also covers integration with other key modules like Sales and Distribution, Material Management, and Production Planning, ensuring unified financial data across the organization. The real-time data processing capabilities of SAP FICO ensure prompt reflection of financial transactions, making it an indispensable tool for maintaining up-to-date and compliant financial records. Enroll in the SAP FICO Course in Mumbai to gain the skills needed for effective financial management and cost control.

Who Can Apply For SAP FICO Course?

- Finance Professionals

- IT Professionals

- Business Professionals

- Graduates and Students

- Career Changers

SAP FICO Course Syllabus

Interview Q&A

SAP FICO is a financial accounting and controlling module that helps businesses in managing their financial transactions, accounting, and reporting activities.

FI stands for Financial Accounting, while CO stands for Controlling. Financial Accounting focuses on recording and managing financial transactions, whereas Controlling focuses on analyzing financial information to help in decision-making.

The sub-modules of SAP FICO are General Ledger Accounting (FI-GL), Accounts Receivable (FI-AR), Accounts Payable (FI-AP), Asset Accounting (FI-AA), Cost Element Accounting (CO-OM-CEL), Cost Center Accounting (CO-OM-CCA), Profit Center Accounting (EC-PCA), and Internal Orders (CO-OM-OPA).

A chart of accounts is a list of all the general ledger accounts used by an organization to record its financial transactions. It helps in classifying and grouping the financial transactions and also provides a framework for the preparation of financial statements.

A financial statement version is a collection of financial statement items that are used to prepare financial statements. It provides a template for presenting the financial data in a specific format that is required by the organization.A financial statement version is a collection of financial statement items that are used to prepare financial statements. It provides a template for presenting the financial data in a specific format that is required by the organization.

6. What is the difference between a balance sheet and a profit and loss statement?

A: A balance sheet shows the financial position of an organization at a specific point in time, whereas a profit and loss statement shows the financial performance of an organization over a period of time.

7. What is a withholding tax in SAP FICO?

A: A withholding tax is a tax that is deducted at the source from payments made to vendors and employees. It is deducted by the payer and remitted to the tax authorities on behalf of the payee.

8. What is a tolerance group in SAP FICO?

A: A tolerance group is a group of users who have the authority to approve or reject transactions that exceed certain predefined limits. The limits can be set for various types of transactions, such as invoice postings or payment transactions.

9. What is a cost center in SAP FICO?

A: A cost center is a unit within an organization that incurs costs and contributes to the organization’s overall expenses. It can be a department, a project team, or any other entity that can be attributed with costs.

10. What is the purpose of automatic payment programs in SAP FICO?

A: Automatic payment programs in SAP FICO automate the payment process by generating payment documents, such as checks or electronic transfers, based on predefined criteria. This helps in reducing manual effort and improving the efficiency of the payment process.

11. What is the difference between a vendor and a customer in SAP FICO?

A: A vendor is a party who supplies goods or services to an organization, while a customer is a party who purchases goods or services from an organization. In SAP FICO, vendors are managed through the Accounts Payable (FI-AP) sub-module, while customers are managed through the Accounts Receivable (FI-AR) sub-module.

12. What is the purpose of the Accounts Payable (FI-AP) sub-module in SAP FICO?

A: The Accounts Payable (FI-AP) sub-module in SAP FICO manages the organization’s accounts payable transactions, including invoice verification, payment processing, and vendor master data maintenance.

13. What is the purpose of the Accounts Receivable (FI-AR) sub-module in SAP FICO?

A: The Accounts Receivable (FI-AR) sub-module in SAP FICO manages the organization’s accounts receivable transactions, including customer invoicing, payment receipts, and customer master data maintenance.

14. What is the purpose of Asset Accounting (FI-AA) sub-module in SAP FICO?

A: The Asset Accounting (FI-AA) sub-module in SAP FICO manages the organization’s fixed assets, including acquisition, depreciation, retirement, and transfer of assets.

15. What is the purpose of Profit Center Accounting (EC-PCA) sub-module in SAP FICO?

A: The Profit Center Accounting (EC-PCA) sub-module in SAP FICO enables organizations to analyze the profitability of individual business segments, such as departments, product lines, or sales regions.

16. What is a company code in SAP FICO?

A: A company code is a legal entity within an organization that is responsible for its own financial accounting transactions, such as recording and reporting financial data.

17. What is the purpose of a controlling area in SAP FICO?

A: A controlling area is a unit within an organization that is responsible for controlling activities, such as cost center accounting, profit center accounting, and internal orders.

18. What is a house bank in SAP FICO?

A: A house bank is a financial institution that is authorized to manage the organization’s bank accounts in SAP FICO. It helps in managing bank transactions, such as payments, receipts, and bank reconciliations.

19. What is the purpose of a profit and cost center hierarchy in SAP FICO?

A: A profit and cost center hierarchy in SAP FICO provides a structure for organizing and analyzing financial data at different levels of aggregation. It enables organizations to report on their financial performance and make informed decisions based on the financial data.

20. What is the purpose of a year-end closing in SAP FICO?

A: A year-end closing in SAP FICO is a process of finalizing financial transactions and preparing financial statements for the year-end reporting period. It includes activities such as posting depreciation, adjusting entries, and carrying forward balances to the new fiscal year.

WHY SHOULD YOU LEARN SAP FICO COURSE IN Mumbai ?

Learning SAP FICO in Mumbai provides access to top-notch training institutes and experienced instructors, ensuring comprehensive knowledge in financial accounting and controlling. Additionally, Mumbai’s vibrant job market offers excellent career opportunities in the SAP domain.

HOW CAN WE HELP YOU LEARN SAP FICO COURSE

Connecting Dots ERP is a premier institute that provides the Best SAP FICO Coaching Classes In Mumbai. Based on the current industry standards, it helps students to get sufficient knowledge and get a job in reputed MNCs. So our course is pocket-friendly. Students from any walk of life can join this course and fulfil their dreams. We have a team of trainers at the SAP FICO Training Course in Mumbai. They have a decade of experience. They are experts and up to date in the topics they teach. They spend time on real-world industry applications. Trainers are working professionals in top MNCs. They will provide you with practical knowledge from the basic to the advanced levels of SAP FICO. For that purpose, they prefer the “learning by doing” strategy. You will get valuable knowledge with hands-on exercises and real-world simulations.

The syllabus of SAP FICO includes Introduction to ERP, general ledger accounting, financial accounting, accounts payable, accounts receivable, asset accounting, reports, CONTROLLING basic settings for controlling, Cost Center Accounting, CO Internal orders, profit center accounting, COPA Reporting, and integration. At the SAP FICO Classes In Mumbai, We have a variety of study materials. Our study material includes books, video lectures, PDFs, Sample questions, interview questions (HR and Technical), and projects. Our skilled trainers have received many prestigious awards for their knowledge of SAP FICO. At the SAP FICO Training Center In Mumbai, they will help you in major project training, minor project training, live project preparation, interview preparation, and job support. Our trainers can teach technical concepts more efficiently. Connecting Dots ERP provides lab facilities and high-tech infrastructure. At SAP FICO Classes In Mumbai, We have efficient lab facilities. They are available 24/7.

Our Top Recruiters

Placement Lifecycle

Eligibility Criterion

Interview Question & Answer

Resume and LinkedIn Formation

Mock Interviews

Scheduling Interviews

Job Placement

SAP FICO Training Certificate

Your degree and abilities are pivotal in launching your career, equipping you with the skills to compete on a global scale. These qualifications open doors to opportunities and ensure you stay competitive in the international job market

FAQs

The SAP FICO course equips you with essential financial and controlling skills, provides hands-on experience, and offers job placement assistance, making you job-ready and enhancing your professional credibility.

The requirements for enrolling in this course include a basic understanding of financial and accounting principles, proficiency in using computers, and a willingness to learn and adapt to new technologies.

Yes, free demo sessions are available for this course, allowing prospective students to experience the curriculum and teaching style before enrolling. These sessions provide a preview of the course content and the learning environment.

The course ensures a supportive learning environment through personalized mentoring, interactive sessions, and collaborative projects. Additionally, students have access to continuous assistance and resources to help them succeed.

The SAP FICO Certification Course lasts for 5 months, providing a comprehensive learning experience. This duration includes theoretical lessons, practical exercises, and a live project.

Student Reviews

SAP FICO Course With 100% Placement

The SAP FICO course with 100% placement assistance stands out as an exceptional opportunity for aspiring financial and controlling professionals. This program is meticulously designed to equip students with in-demand skills and practical experience, ensuring they are industry-ready.

Get Industry-Ready with Dedicated Career Support:

- Industry-Ready Advanced Curriculum: Covering essential topics such as machine learning, big data analytics, data visualization, and more.

- Certificate from Connecting Dots ERP: Gain a recognized certification that enhances your professional credibility.

- Expert Faculty: Learn from industry professionals with extensive experience and knowledge.

- Interview Opportunities with Leading Companies: Access exclusive job interview opportunities with top companies.

- Dedicated Placement Assistance: Benefit from personalized support to help secure your ideal job.

- Real-World Case Studies: Engage in hands-on projects and case studies that provide practical exposure.

Connecting Dots ERP provides training for software courses like SAP FICO, SAP S/4HANA, SAP MM, SAP SD, SAP HCM, SAP PP, SAP QM, SAP PM, and SAP Ariba.

SAP FICO Training in Mumbai

SAP FICO Certification Training locations in Mumbai : SAP FICO Course in Mumbai, SAP FICO Course in Thane, SAP FICO Course in Kalyan, SAP FICO Course in Bhandup, SAP FICO Course in Khopoli, SAP FICO Course in Titwala, SAP FICO Course in Ulhasnagar, SAP FICO Course in Vashi, SAP FICO Course in Badlapur, SAP FICO Course in Ghatkopar, SAP FICO Course in Aroli, SAP FICO Course in virar, SAP FICO Course in ambarnath, SAP FICO Course in Kurla, SAP FICO Course in Diva, SAP FICO Course in Mulund, SAP FICO Course in Matunga, SAP FICO Course in nerul, SAP FICO Course in dadar, SAP FICO Course in andheri, SAP FICO Course in navi mumbai, SAP FICO Course in powai, SAP FICO Course in ghansoli, SAP FICO Course in dombivali, SAP FICO Course in bhiwandi, SAP FICO Course in mulund, SAP FICO Course in bandra, SAP FICO Course in Borivali

Still have queries? Let’s Connect

- SAP S/4 HANA Course

- SAP MM Course

- SAP PP Course

- SAP FICO Course

- SAP SD Course

- SAP ABAP Course

- SAP BASIS Course

- HR Core Course

- HR Analytics Course

- HR Generalist Course

- HR Management Course

- Digital Marketing Course

- SEO Course

- SMM Course

- PPC Course

- WordPress Course

- Data Science Course

- Data Analytics Course

- Full Stack Python Course

- Full stack Java Course

- Salesforce Course

Contact US

Pune:

Call us at: 9004002958, 9004002941, 9004008313

Mumbai:

8th Floor, Paradise Tower, next to MCDonalds, Naupada, Thane West, Mumbai, Thane, Maharashtra 400601

Call us at: 7517542233, 9004001938, 8805563870